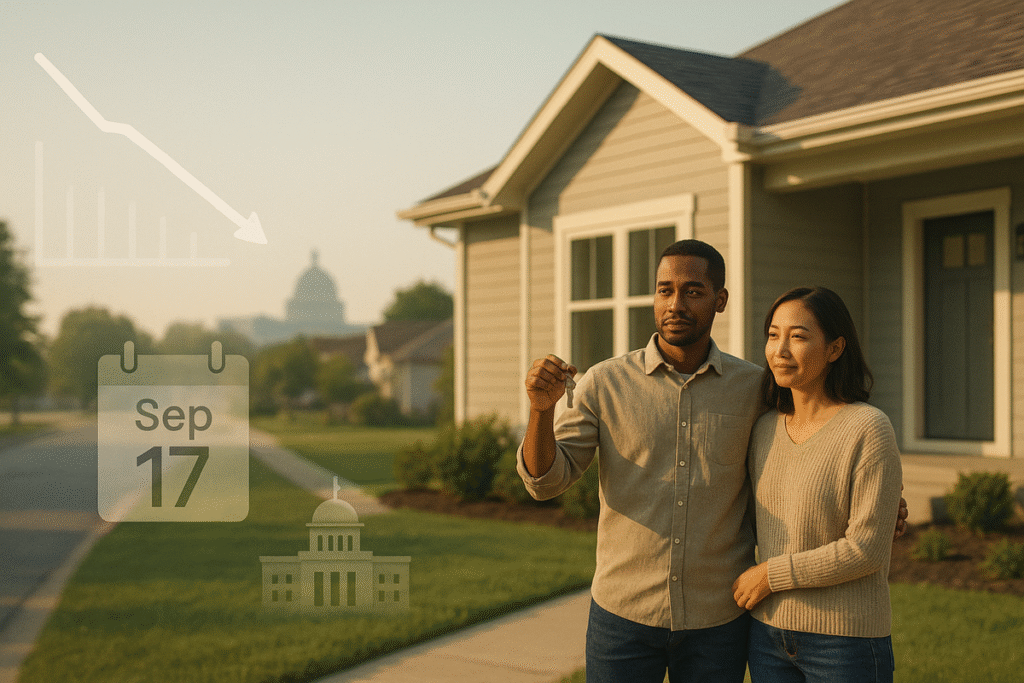

Mortgage rates in the U.S. have fallen to a one-year low, giving homebuyers a welcome boost. The average 30-year fixed mortgage rate dropped to 6.17%, marking the lowest level in over a year.

Lower borrowing costs improve affordability for buyers, making it easier to purchase homes or refinance existing mortgages. The decline in rates may encourage more people to enter the housing market.

Real estate experts say this development could help slow price declines in the market. As mortgage rates drop, buyers can afford more without increasing monthly payments, which supports housing demand.

The rate drop suggests the housing market may be entering a more favorable phase for buyers. Many potential homeowners have been waiting for more affordable financing, and the current rates create an opportunity for those ready to act.

Lower rates also benefit first-time buyers, who are particularly sensitive to monthly payments. Even small decreases in mortgage costs can significantly expand the pool of affordable homes.

Refinancing activity is expected to rise as existing homeowners take advantage of lower rates. This could reduce monthly payments for many families, freeing up funds for other expenses and stimulating the broader economy.

Lenders and real estate agents report growing interest from buyers, citing affordability as a key factor. The combination of lower rates and stabilized home prices is encouraging renewed activity in the market.

While rates remain above historic lows, the downward trend provides relief after a period of rising borrowing costs. Economists suggest that continued monitoring of inflation and Federal Reserve policy will influence future rate movements.

The drop in mortgage rates may also support construction and home sales. Builders benefit when more buyers can afford homes, which can lead to increased inventory and more options for prospective homeowners.

Overall, the decline in U.S. mortgage rates provides an opportunity for homebuyers to take advantage of improved affordability. The market may see a boost in activity as buyers and refinancers respond to the lower costs.